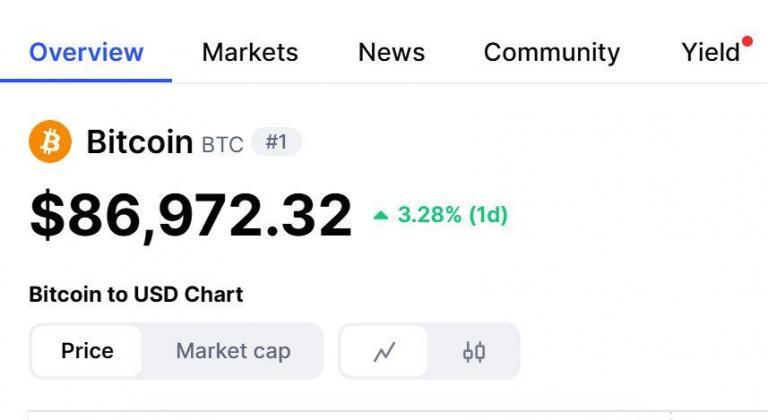

As of March 24, 2025, Bitcoin (BTC) is trading at approximately $86,971, reflecting a 3.27% increase from the previous day. Bitcoin Today with Price Update 24 Mar 2025 shows the cryptocurrency’s intraday movements. It has seen a high of $87,004. It has also seen a low of $84,186.

Recent market analyses suggest a bullish trend for Bitcoin today, with price updates showing a significant rise. Some forecasts predict that BTC could reach $103,487 by March 28, 2025, indicating a potential 21.43% increase over the next five days. Indeed, Bitcoin’s options trading volume has surged, nearing $800 million, with analysts eyeing a $90,000 target. However, in the Bitcoin price update, you’ll notice resistance around the $87,200 mark and technical signals suggest potential pullbacks. Indeed, Bitcoin today reflects a strong market activity as highlighted in the price update on 24 Mar 2025.

For those interested in investing in Bitcoin today, choosing a reputable and user-friendly platform is crucial. Binance stands out as a leading cryptocurrency exchange, offering a wide range of benefits to its users:

- Extensive Cryptocurrency Selection: Binance provides access to hundreds of cryptocurrencies, including Bitcoin, allowing for diversified investment opportunities.

- Competitive Trading Fees: With trading fees as low as 0.1%, Binance ensures cost-effective trading experiences for its users.

- Auto-Invest Feature: This feature enables users to automate their cryptocurrency investments, facilitating passive income generation.

To embark on your Bitcoin today investment journey with Binance, consider signing up through this affiliate link. This platform’s robust features and user-centric tools can support both novice and experienced investors in navigating the dynamic cryptocurrency market.

In conclusion, Bitcoin’s current market performance and future projections present compelling opportunities for investors. With the price update on 24 Mar 2025, Bitcoin today shows positive momentum. Make sure you stay informed about the Bitcoin price update. This ensures that using Binance’s comprehensive services can enhance your investment experience. They provide the tools and resources necessary to make informed decisions in the evolving world of cryptocurrency today.

Bitcoin, the world’s first and most valuable cryptocurrency, continues to be a dominant force in the financial landscape. Created in 2009 by the pseudonymous Satoshi Nakamoto, it operates on a decentralized peer-to-peer network called blockchain. Unlike traditional currencies, it is not controlled by any government or central bank.

Table of Contents

Bitcoin Today: Key Considerations

Its price is notoriously volatile, driven by factors like investor sentiment, regulatory news, institutional adoption, and macroeconomic trends. Deciding to invest in it requires considering one’s risk tolerance. It also depends on investment goals and understanding of the technology.

As of today, the Bitcoin market is characterized by several key themes:

- Institutional Adoption: Major companies, asset managers, and even publicly traded funds have begun adding Bitcoin to their balance sheets. This action lends Bitcoin a new level of legitimacy.

- Regulatory Uncertainty: Governments around the world are still grappling with how to regulate cryptocurrencies. News of potential regulations or bans can cause significant price swings.

- The “Digital Gold” Narrative: Many proponents view Bitcoin as a store of value. They see it as a hedge against inflation, similar to gold. This is due to its capped supply of 21 million coins.

- High Volatility: Bitcoin’s price can experience dramatic increases and decreases in short periods. This presents opportunities for high returns but also carries a high risk of substantial losses.

- Macroeconomic Factors: Like other risk assets, Bitcoin’s price is influenced by broader economic conditions. These include interest rates and investor risk appetite.

Should You Invest in Bitcoin?

This is not a question with a universal yes or no answer. It depends entirely on your personal circumstances.

You might consider investing if you:

- Have a high risk tolerance and can stomach potential large, short-term losses.

- Are investing for the long term and believe in the future of decentralized digital assets.

- Understand the technology and its potential use cases.

- Already have a diversified portfolio of traditional investments. These include stocks, bonds, and real estate. You are using Bitcoin as a speculative addition with high-growth potential.

- Only invest money you are prepared to lose entirely.

You should likely avoid investing if you:

- Have a low risk tolerance or need guaranteed stability for short-term financial goals.

- Are looking for a quick, guaranteed profit.

- Do not understand how Bitcoin works or how to store it securely.

- Would need to go into debt to purchase it.

Disclaimer: This is not financial advice. You must conduct your own research and consider consulting with a qualified financial advisor before making any investment decisions.

Comparison Table: Bitcoin vs. Other Assets

| Feature | Bitcoin (Cryptocurrency) | Stocks (e.g., S&P 500 ETF) | Gold (Commodity) | Government Bonds |

|---|---|---|---|---|

| Primary Purpose | Digital store of value; decentralized payment network | Ownership in a company; share in profits | Physical store of value; hedge against inflation | Loan to a government; fixed income |

| Volatility | Very High | Moderate to High | Moderate | Very Low |

| Potential Return | Very High (speculative) | High (over the long term) | Moderate | Low |

| Risk Level | Very High | Moderate to High | Moderate | Very Low |

| Regulation | Evolving/Uncertain | Highly Regulated | Regulated Market | Highly Regulated |

| Liquidity | High (on major exchanges) | Very High | High | Very High |

| Income Generation | No (unless staked via other methods) | Dividends | No (unless held in certain funds) | Interest Payments |

| Tangible Asset | No (Digital) | No | Yes | No |

| Inflation Hedge | Theoretical (debated) | Yes (over time) | Proven historical hedge | Poor (fixed returns lose value to inflation) |

Conclusion

Bitcoin represents a revolutionary technological innovation with the potential for significant financial reward, but it comes with equally significant risk. Its value proposition as “digital gold” is compelling to many. However, it remains a highly speculative asset class compared to established investments like stocks or bonds.

The decision to invest should not be taken lightly. It is crucial to approach it with a clear understanding of its volatility. You should also consider the ongoing regulatory developments. Moreover, understand its role within a broader, diversified investment strategy.

For those with the appropriate risk appetite, allocating a small portion of a portfolio to Bitcoin might be wise. This applies if they have a long-term perspective. For everyone else, caution and further education are strongly advised. Ultimately, the market is young, and its future, while promising, is still being written.

3 Comments

0zls3e

yxg411

19zpoi